Peter Schiff statements that Bitcoin ETF buyers are at a downside of a 20% decline – are his statements exact?

- Bitcoin enthusiasts are celebrating a optimistic convert of gatherings, as Bitcoin ETFs saw a web influx of $73 million by June 28th.

- Inspite of first concerns about BTC, ETH, and SOL, the decreasing value volatility alerts a a lot more secure industry.

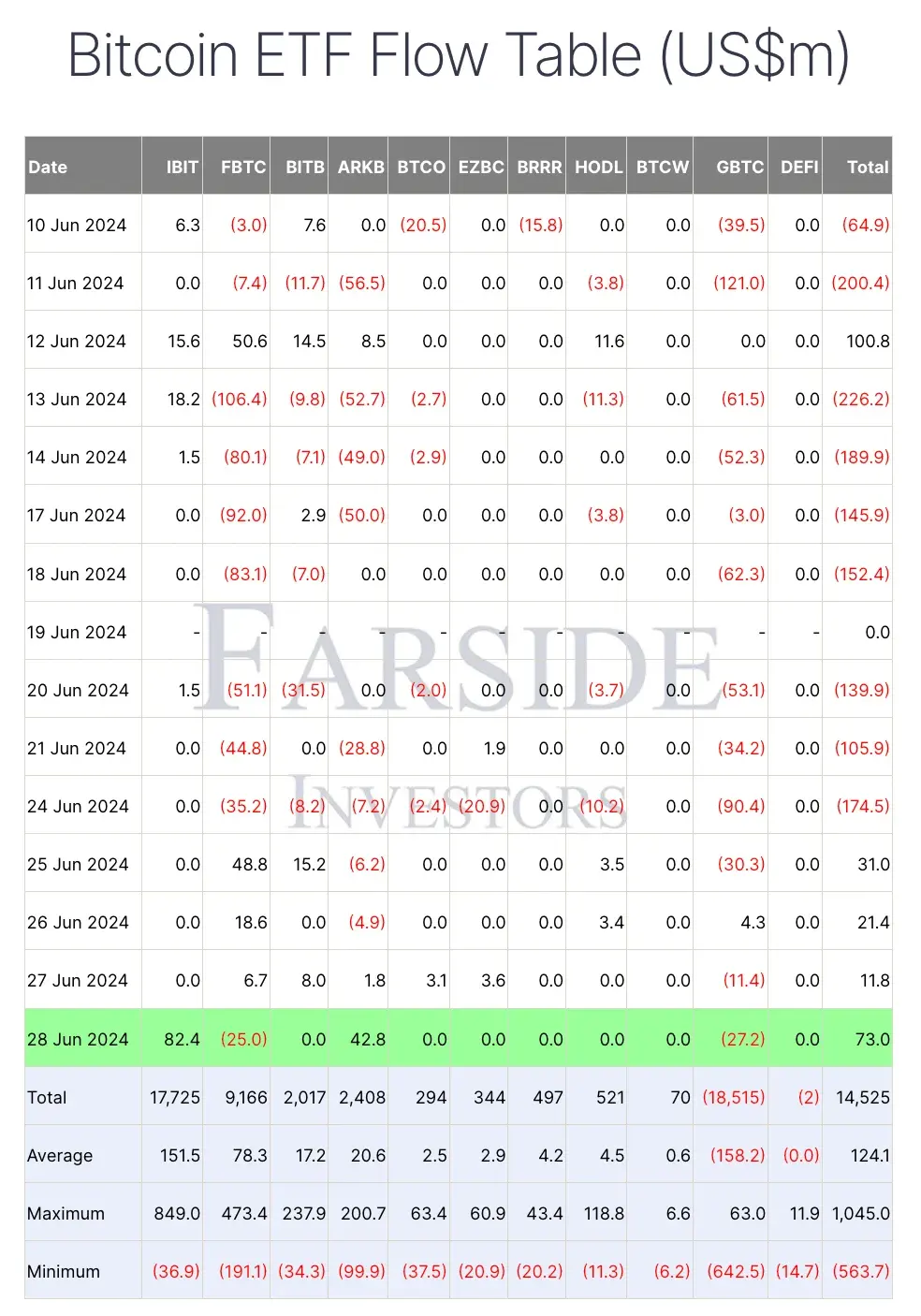

After a period of time of outflows, Bitcoin [BTC] ETFs are on the increase. The hottest details on June 28th reveals a $73 million net inflow into BTC ETFs.

The Flow of Bitcoin ETFs: An Overview

Leading the cost with the most inflows is BlackRock’s iShares Bitcoin Have confidence in (IBIT), bringing in $82.4 million. In distinction, Grayscale Bitcoin Rely on (GBTC) professional outflows of $27.2 million, adopted by Fidelity’s FBTC with $25 million in outflows.

Resource: Farside Buyers

The earlier data from June 26th showed FBTC and GBTC as the only kinds with inflows, $18.6 million and $4.3 million respectively, along with VanEck’s HODL at $3.4 million.

All other ETFs remained neutral in their flows, except for ARK 21Shares’ ARKB, which saw outflows of $4.9 million.

Peter Schiff’s Just take on BTC ETF

Peter Schiff, effectively-identified for his skepticism towards Bitcoin, has shared his thoughts on the BTC ETFs. Drawing parallels with Gold ETFs, he pointed out the efficiency variation in between the two property.

“#Gold acquired 4% by the close of Q2, whilst #Bitcoin is at the moment down by more than 15%.”

Schiff’s criticism led to conversations among buyers, with some questioning the choice to change from gold to Bitcoin ETFs.

“Investors who swapped gold ETFs for Bitcoin ETFs at the stop of Q1 are now struggling with a 20% reduction. The scenario may well worsen for them in the potential.”

Nonetheless, a user named Bitcoin Clown responded to Schiff with a distinctive perspective, highlighting the possible in Bitcoin ETFs.

Source: Bitcoin Clown/X

Validating Schiff’s Promises

Peter Schiff’s analysis of Bitcoin ETFs has been met with skepticism. Current knowledge exhibits that U.S. Location Bitcoin ETFs have been attaining traction, with a few consecutive days of optimistic inflows.

In the previous few days, these ETFs have attracted $137.2 million in new investments, indicating a increasing fascination and self-assurance in these financial instruments.

A further user, Lord Crypto, also weighed in on the dialogue, emphasizing the present-day constructive trend in Bitcoin ETF investments.

Resource: Lord Crypto/X

The long term of Bitcoin ETFs stays unsure, especially with the impending start of Ethereum [ETH] ETFs. On top of that, VanEck and 21Shares have filed for a Solana [SOL] ETF, adding to the market’s uncertainty.

Effects on Crypto Charges

Bitcoin, Ethereum, and Solana price ranges have observed insignificant dips of .88%, 1.68%, and 2.22% respectively in the past 24 hrs, centered on facts from CoinMarketCap.

Inspite of this, Santiment information assessment by AMBCrypto displays a decrease in cost volatility, indicating a a lot more stable industry natural environment for buyers.

Resource: Santiment

This shift signifies a more secure and significantly less unstable market place, furnishing a safer investment ecosystem for traders.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!