Bitcoin: Ought to You Purchase or Promote? What is actually the Up coming Shift?

- In spite of a the latest drop to $56.8k, Bitcoin appears to have a small-expression bearish inclination.

- Although symptoms of accumulation and demand are visible, the consolidation period may well persist for a while.

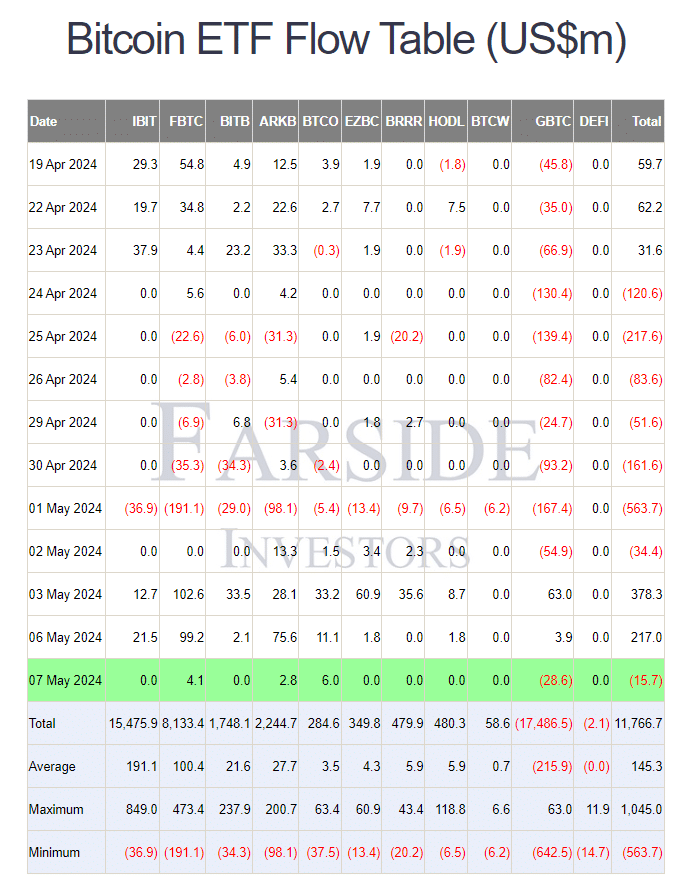

Around the past week, Bitcoin [BTC] has surged by 4.6%. The increase in Bitcoin ETF inflows indicates that the bulls are attaining momentum.

In May, the Grayscale Bitcoin ETF GBTC, recognised for dependable outflows, observed a shift.

Supply: Farside Investors

Irrespective of this constructive pattern, the limited-term bias remains bearish. The specialized indicators continue to lean towards a bearish sentiment. It is essential to delve into on-chain metrics for perception into long run value movements.

Knowing Lengthy and Small-phrase Views

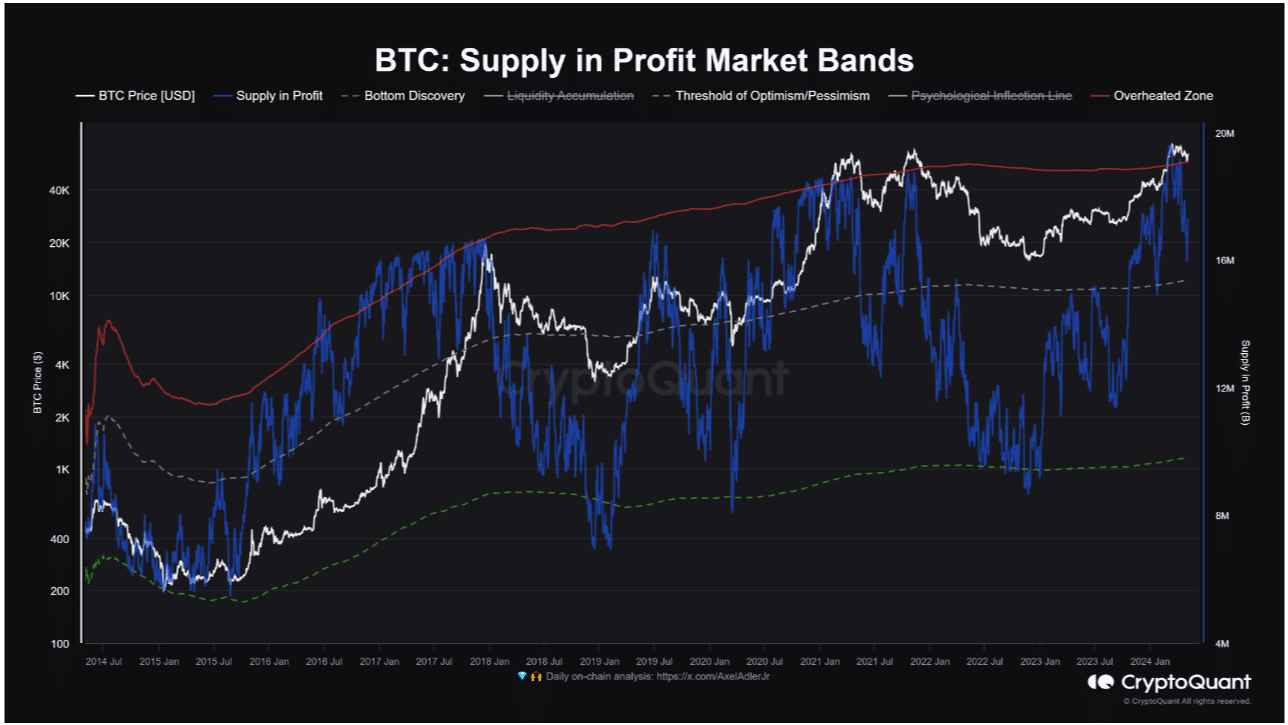

According to Kripto Mevsimi’s investigation on CryptoQuant Insights, the recent correction led to a decrease in Bitcoin supply in earnings.

Various bands have been employed to spotlight zones of overheating, base discovery, and optimism/pessimism thresholds.

Currently, the metric is approaching a critical threshold. A crack underneath could cause a important correction in the direction of the bottom discovery amount.

Protecting over this line could sustain positive sector sentiment, giving bulls hope for a resurgence.

In past cycles, the offer in profit metric remained overheated for prolonged durations with no main corrections. We are but to reach that phase in the present-day cycle.

Bitcoin bulls purpose to protect the gray line, encouraging rate recovery and a attainable rally in the subsequent months akin to previous bull operates.

Timing the Market place: Acquiring Bitcoin Now or Later on?

Whilst the lengthy-term outlook for Bitcoin remains optimistic, the short-phrase suggests bearish tendencies. A possible correction looms.

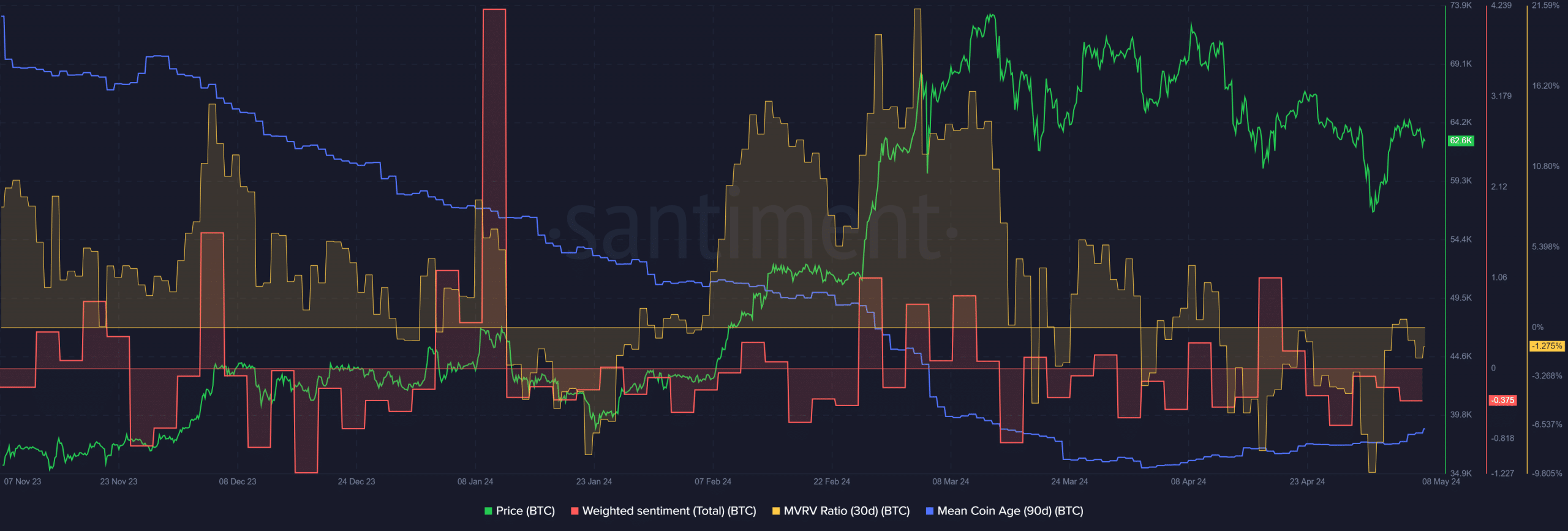

AMBCrypto’s investigation into Santiment metrics aims to unveil likely obtaining possibilities.

Inspite of the undervalued nature of the asset highlighted by the damaging 30-day MVRV, the 3-day weighted sentiment has remained pessimistic in current months.

Check out Bitcoin’s [BTC] Price Prediction for 2024-25

The mean coin age metric reveals signs of stabilization over the previous month, hinting at a reversal. Coupled with MVRV, this craze implies a favorable time to invest in Bitcoin.

Inspite of these signals, current price tag action favors bears, with a doable dip to $55k in the approaching months.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!