What arrives next as AVAX plummets following questionable whale transactions?

- Main plunge in AVAX costs attributed to shady whale action.

- Derivatives marketplace maintains bullish outlook in spite of current fall.

It really is been a wild journey for Avalanche (AVAX) as costs tumbled by 10% in a short span, mostly owing to some important whale actions.

A notable player shifted 1.96 million AVAX, close to value $54.2 million, to popular platforms like Coinbase, Binance, Gate, and THORChain.

Is a crypto marketplace shakeout on the horizon?

Is AVAX in Disaster?

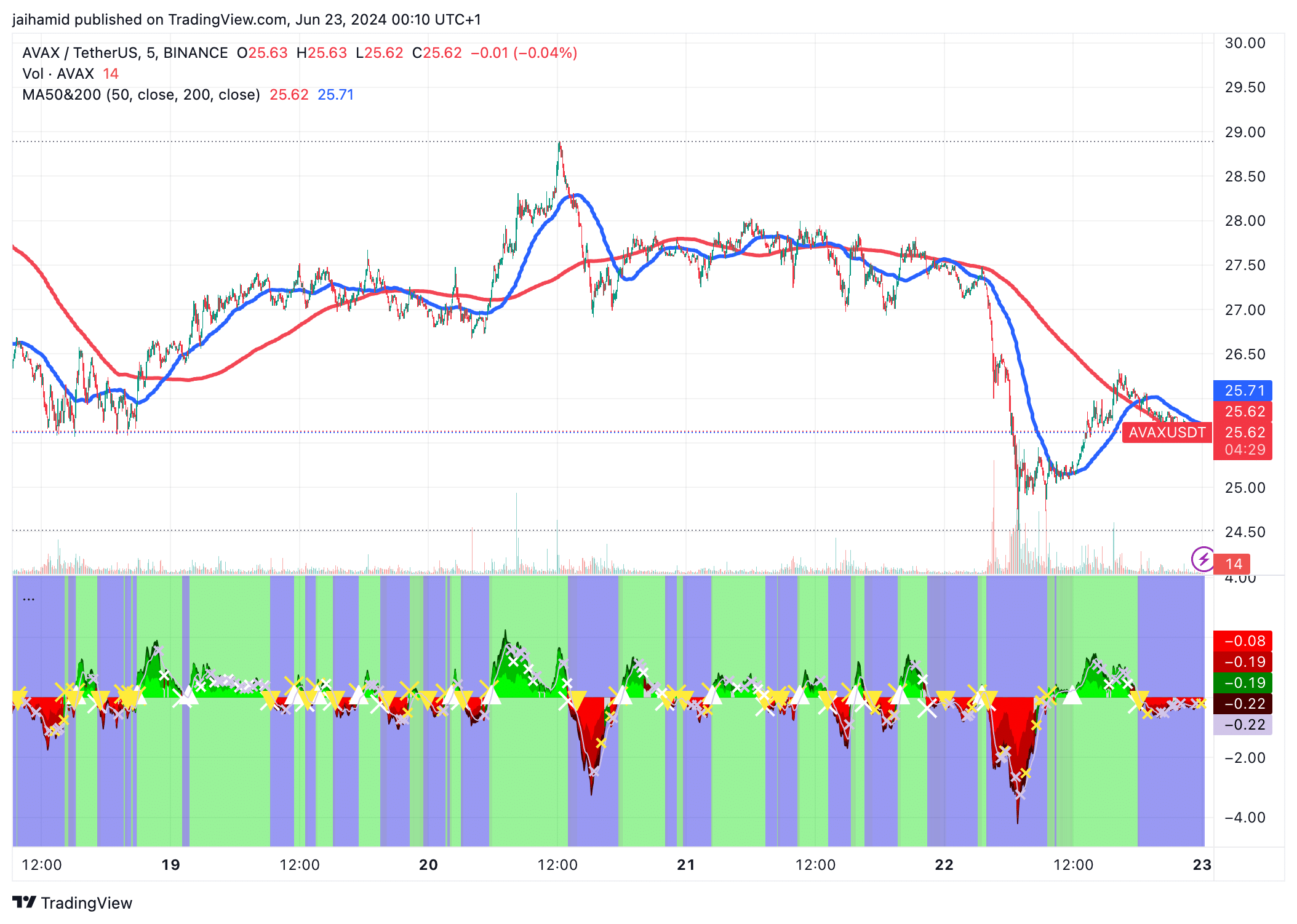

AVAX’s 50-time period Going Regular dipped under the 200-period MA, signaling a “dying cross,” a bearish indicator in buying and selling circles.

Present figures exhibit costs hovering close to the 200-period MA, suggesting a tricky resistance stage all-around $25.73.

Source: TradingView

As a result of the sharp selling price dips, heightened investing volumes had been apparent, especially all through the plunge from $28 to underneath $26, suggesting solid marketing activity.

Hope on the Horizon

You should not get rid of religion in AVAX just nonetheless.

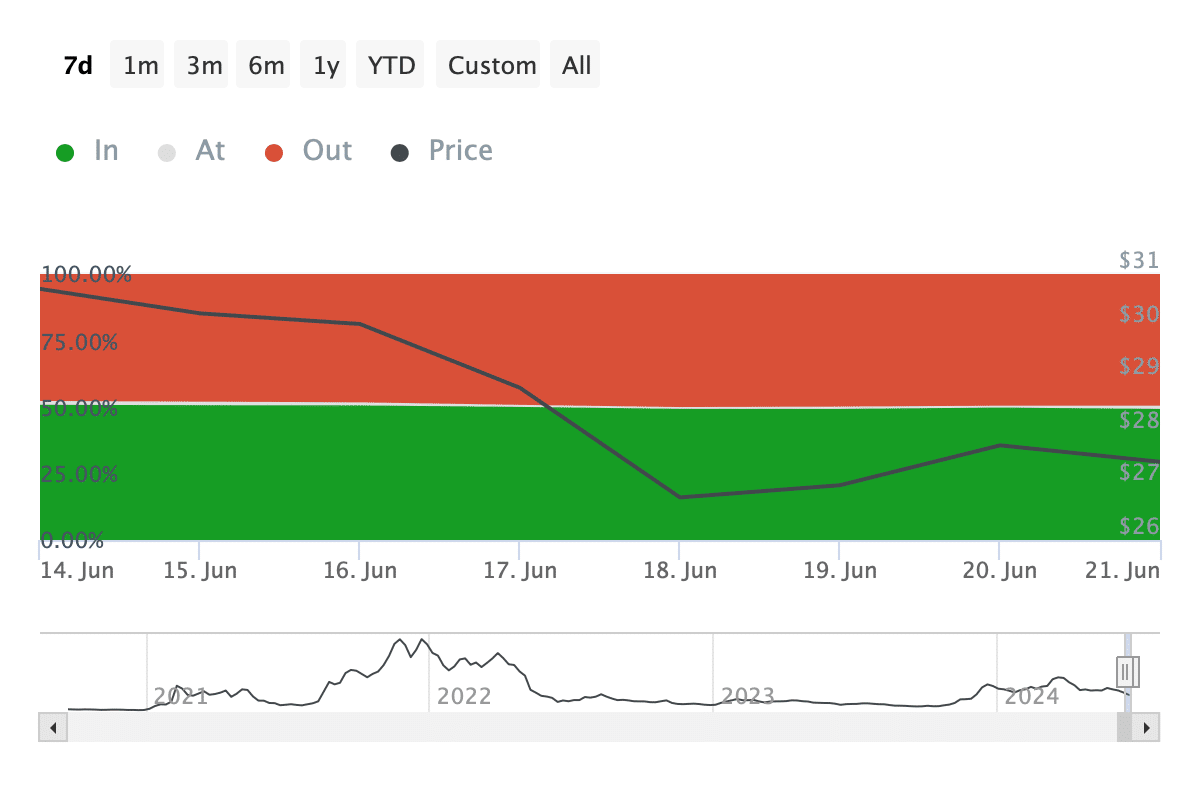

Investors ‘In the Money’ noticed significant reductions in their holdings, possibly indicating revenue at a decline.

Supply: IntoTheBlock

If the variety of ‘Out of the Money’ addresses proceeds to dwindle or stabilize when ‘In the Money’ addresses rise, AVAX could mount a potent comeback.

But, external influences or much more significant offer-offs could toss a wrench in the is effective.

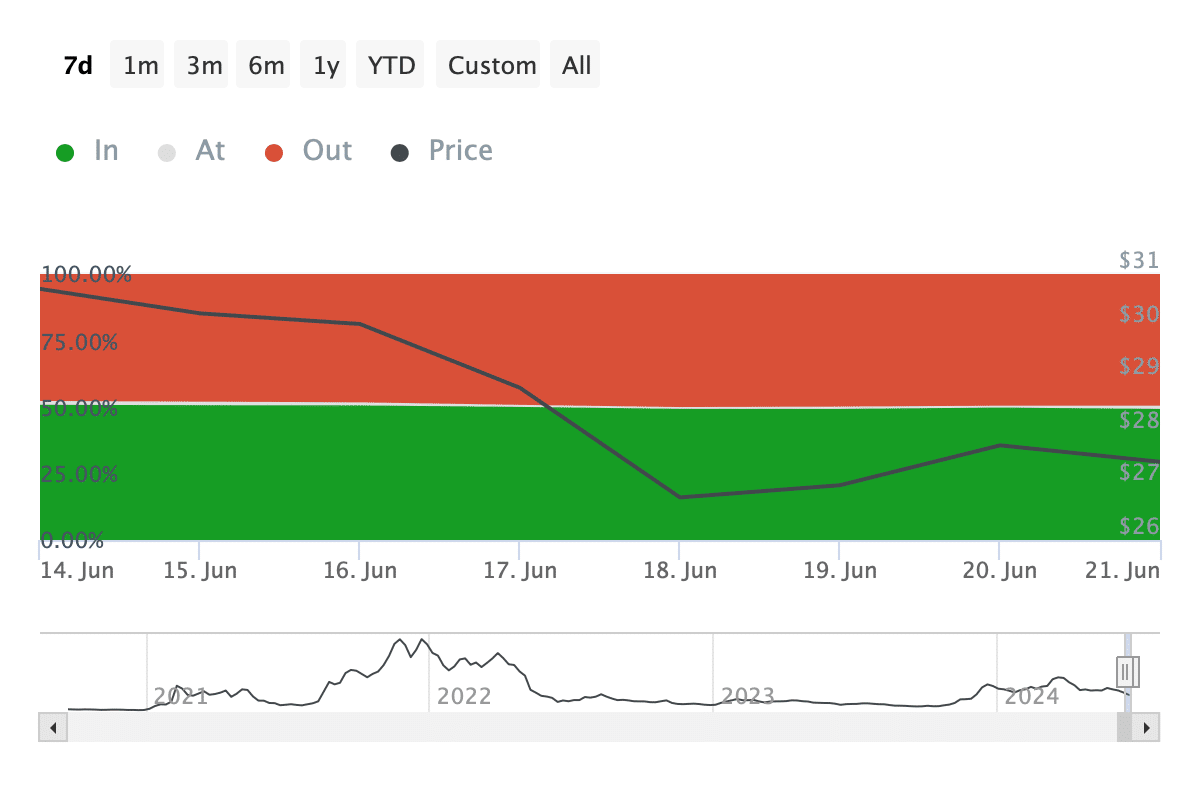

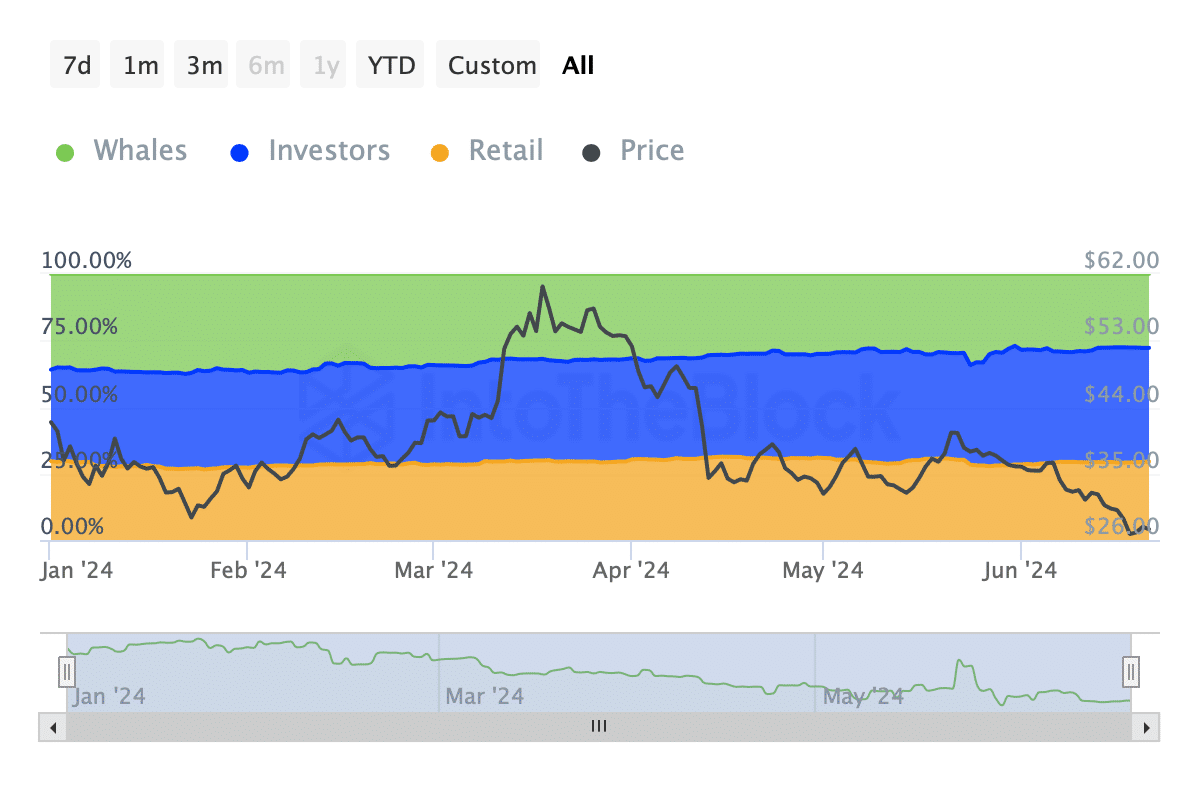

Info paints a blended photo, hinting at attainable stabilization from whales and escalating investor curiosity, countering the affect of retail selloffs.

Supply: IntoTheBlock

Regardless of the rate drops, significant holders seem to be unfazed, neither depositing nor withdrawing considerable quantities of AVAX, potentially indicating a strategic go for upcoming value actions.

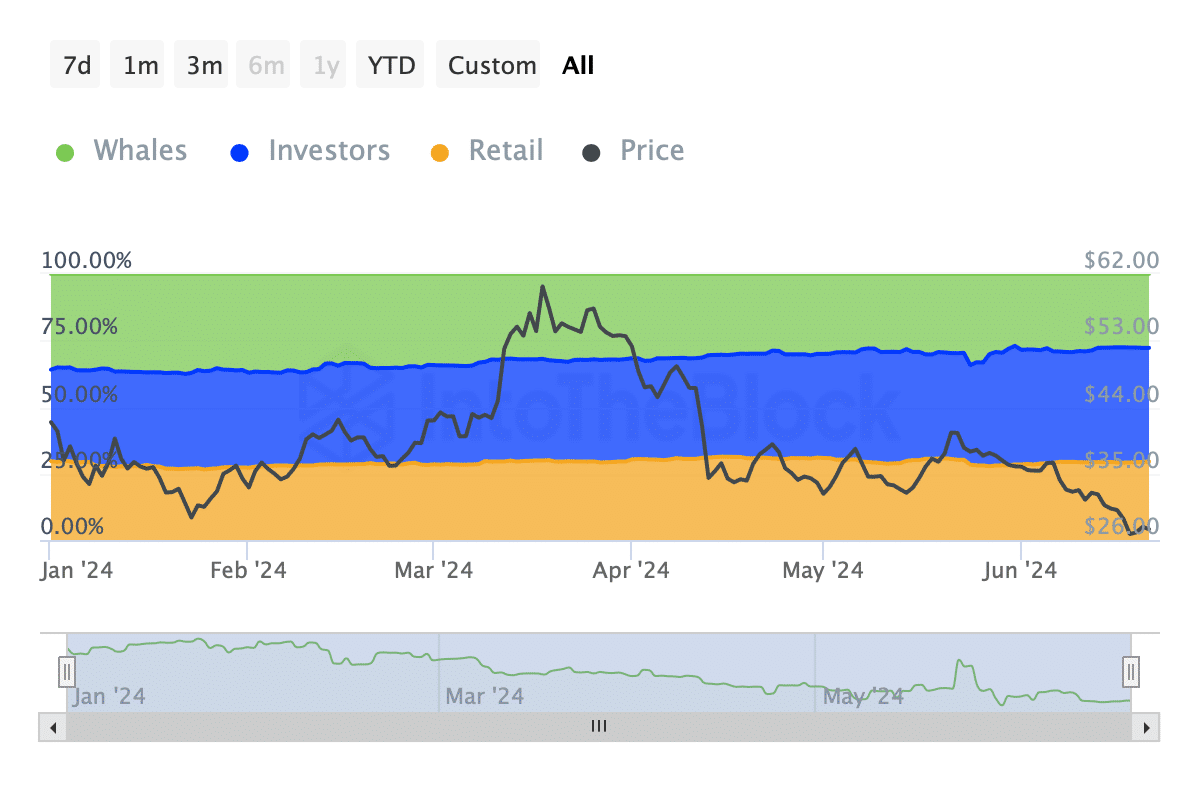

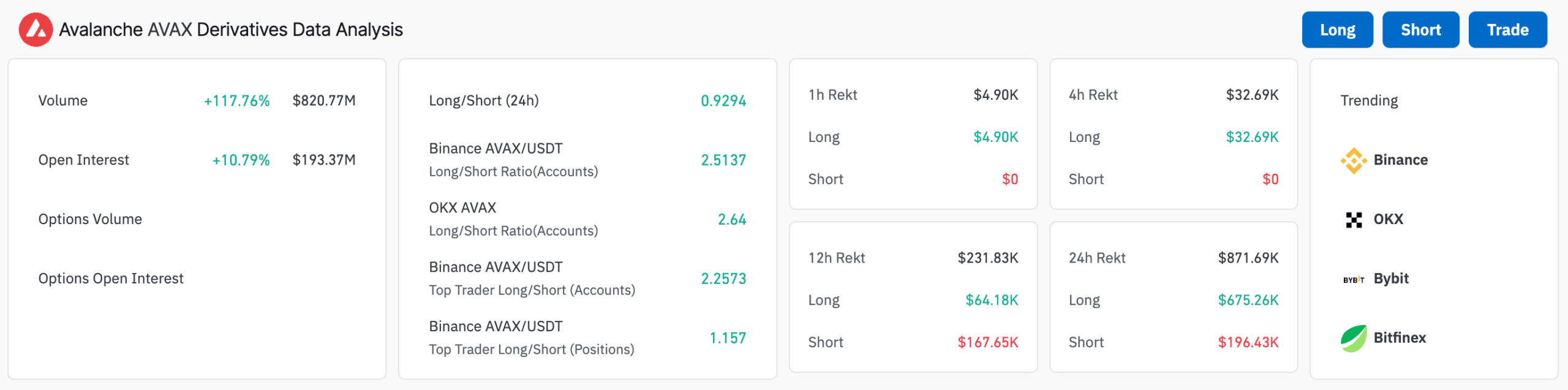

On the other hand, the derivatives market for Avalanche is buzzing with action, demonstrating a constructive urge for food among the traders.

Resource: Coinglass

A Search at AVAX Sector Cap in BTC Terms

Both equally retail and prime traders on big exchanges are self-assured in AVAX’s bullish probable. The latest losses have primarily been on the extensive side, with a reduction of $675.26K in the previous 24 hrs, contrasting with $196.43K on the brief facet.

This unanticipated sector movement goes in opposition to the prevailing bullish sentiment.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!