ETFs steal the highlight as Bitcoin and Ethereum dazzle – Here is why.

- Pleasure for altcoins grows though Bitcoin remains dominant.

- Never undervalue the continued interest from retail buyers.

2024 has been an eventful 12 months in the environment of cryptocurrency. From the significantly-expected Bitcoin halving to the ever-switching selling price fluctuations, buyers have witnessed substantial shifts.

Scrutiny from regulatory bodies like the SEC and now the FBI has additional a new layer of complexity to the industry.

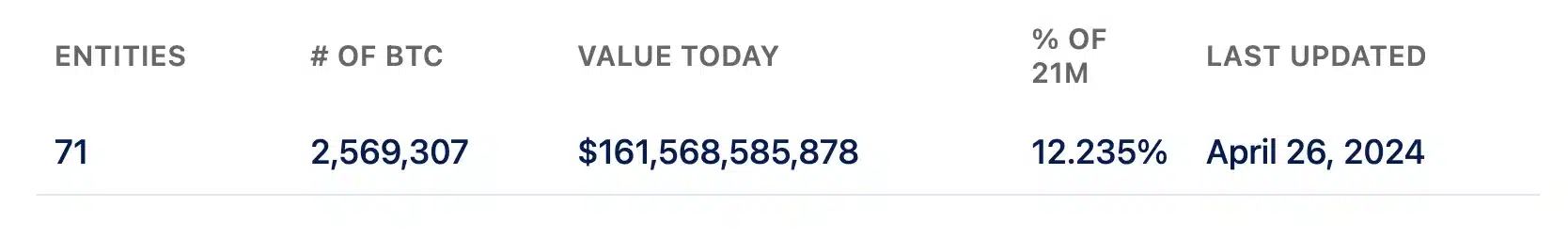

Regardless of these worries, traders stay captivated by the top cryptocurrency, Bitcoin, according to AMBCrypto’s analysis of Bitbo data.

Resource: Bitbo

Talking about this, Zach Pandl, Managing Director of Study at Grayscale Investments, expressed his bullish outlook on the asset course in a current discussion with Anthony Pompliano.

“I am extremely bullish on this asset class.”

Bitcoin vs . altcoins?

In contrast to Pandl’s stance, Brett Tejpaul, Head of Coinbase Institutional, expressed his enthusiasm for altcoin products and solutions in excess of Bitcoin and Ethereum.

“As exciting as Bitcoin and Ethereum are, the altcoin merchandise to me are considerably much more remarkable.”

He emphasised that this demonstrates the resilience and rationale of individuals investing in these merchandise, underscoring the escalating enjoyment close to altcoins in the crypto sector.

In spite of sector fluctuations, altcoins like Uniswap, Cardano, Polkadot, and Solana keep on to appeal to substantial interest and investments.

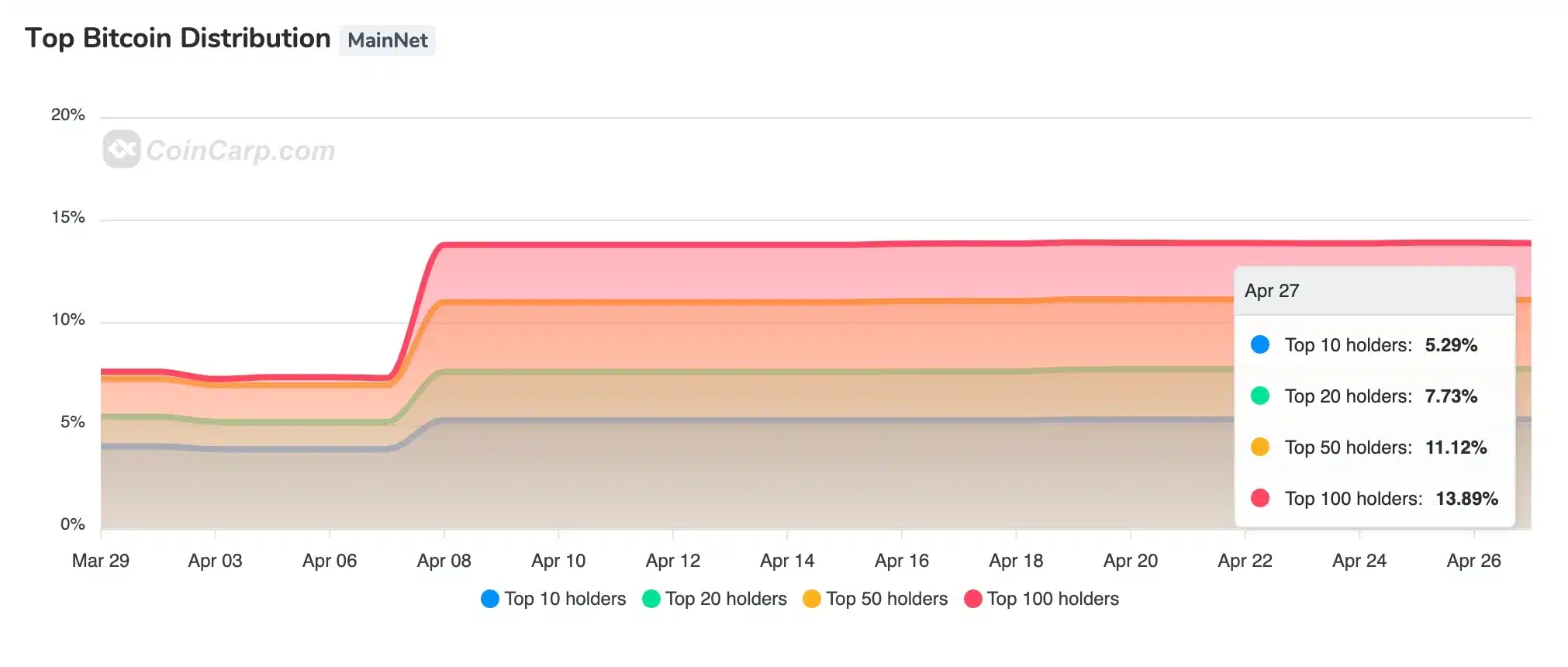

This craze is supported by knowledge from CoinCarp, revealing that the prime 10 holders collectively individual only 5.29% of the whole BTC offer.

Source: CoinCarp

Bitcoin stays at the forefront

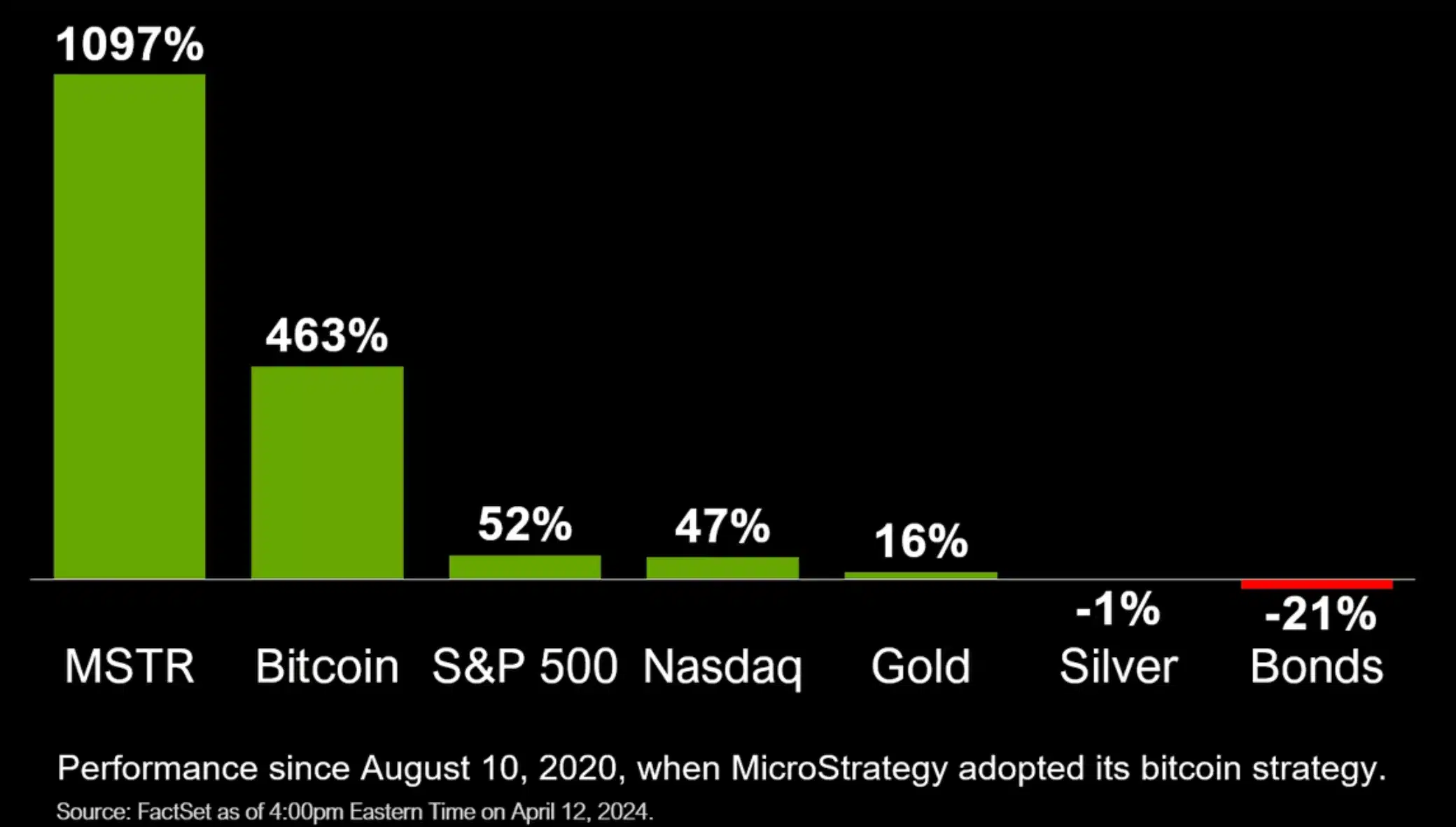

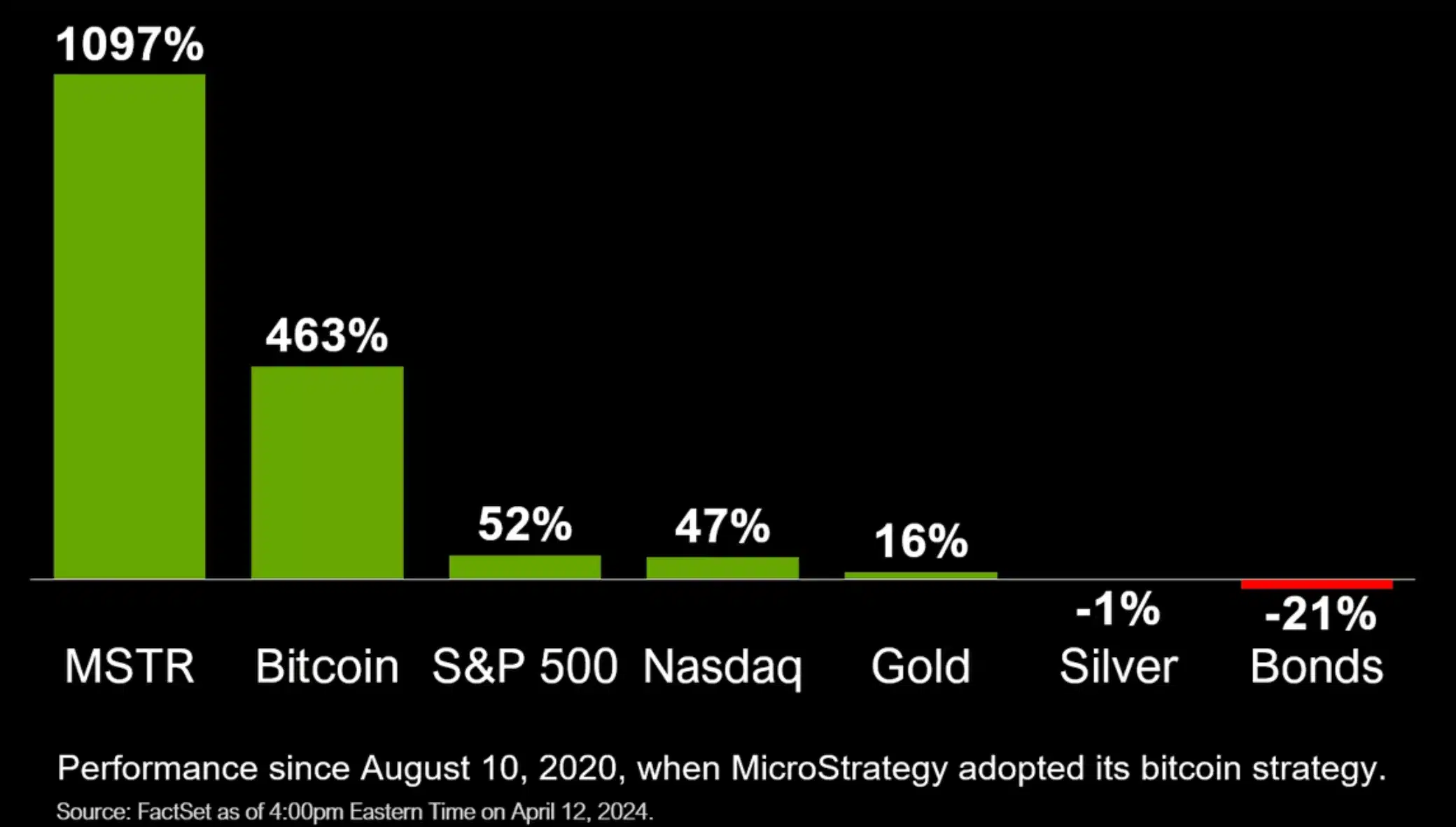

In contrast to Tejpaul’s desire, Michael Saylor’s optimism towards Bitcoin stays unwavering. As a result of a chart shared on X (previously Twitter), he showcased how BTC has been a worthwhile undertaking for his firm.

Resource: Michael Saylor/Twitter

As of March 19, MicroStrategy held 214,246 BTC.

Source: Bitbo

In 2021, institutional curiosity propelled Bitcoin’s surge, setting a new milestone.

With the introduction of BTC Trade Traded Cash (ETFs) in 2024, institutional engagement has surged, underscoring their purpose in influencing demand and costs.

Effect of retail buyers

Amid the excitement all-around institutional involvement via ETFs, it really is essential not to overlook the essential contribution of retail investors.

Echoing this sentiment, Russell Star, Head of Funds Marketplaces at Defi & Valour, highlighted the dual impression of institutional and retail participation in ETFs.

The ETF welcomes a blend of institutional and retail buyers.

Finally, although ETFs enhance liquidity for institutions, it’s crucial to admit that early adopters currently have immediate cryptocurrency investments.

Consequently, while ETF acceptance signifies a substantial milestone, it could just take time for institutional money to completely materialize.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!