This group makes significant moves as Bitcoin falls below critical support level

- Bitcoin enthusiasts are pleased to witness the cryptocurrency holding steady at $64,000.

- Nearly 2 million accounts have invested in BTC at this price point, showcasing confidence in its value.

Bitcoin [BTC] recently slipped below a crucial support level it had maintained for weeks. However, there is another less visible support level that could prevent further drops in price.

Any further decline below this undisclosed threshold might trigger a sell-off and lead to a series of downturns in the market.

Adding to the pressure, miners are selling record amounts of BTC in response to the downward trend in prices.

Bitcoin Faces Resistance at Former Support Level

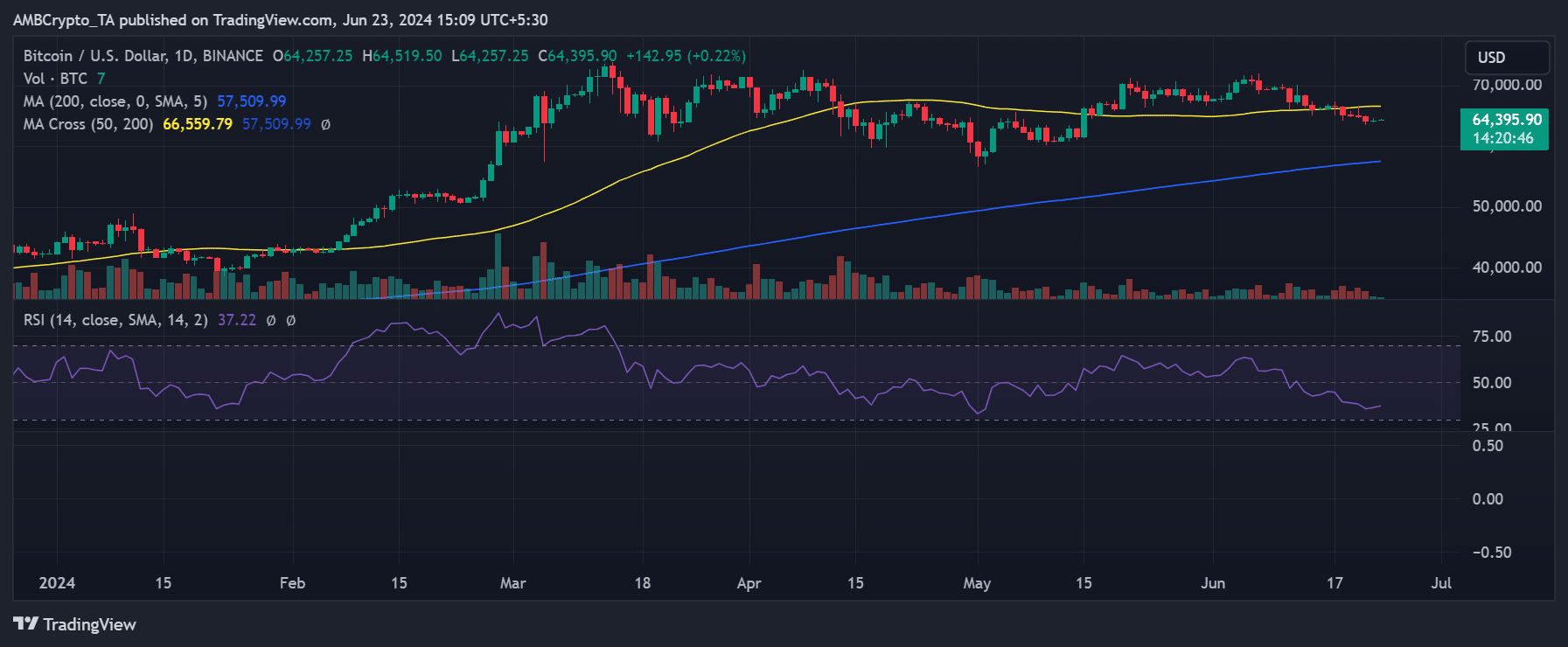

A recent examination by AMBCrypto discovered that Bitcoin broke through its support level at around $66,000. This level was reinforced by the short-term moving average, holding steady from mid-May to mid-June.

The breach signifies a significant shift in Bitcoin’s market behavior, indicating a potential change in direction.

Source: TradingView

The latest update shows Bitcoin trading at around $64,380 with a slight uptick. Despite closing with a small gain on June 22nd, it is still below the former support turned resistance level of $66,000.

The multitude of transactions at the $66,000 range highlights its importance in the market, creating a significant psychological and technical barrier for Bitcoin’s price action.

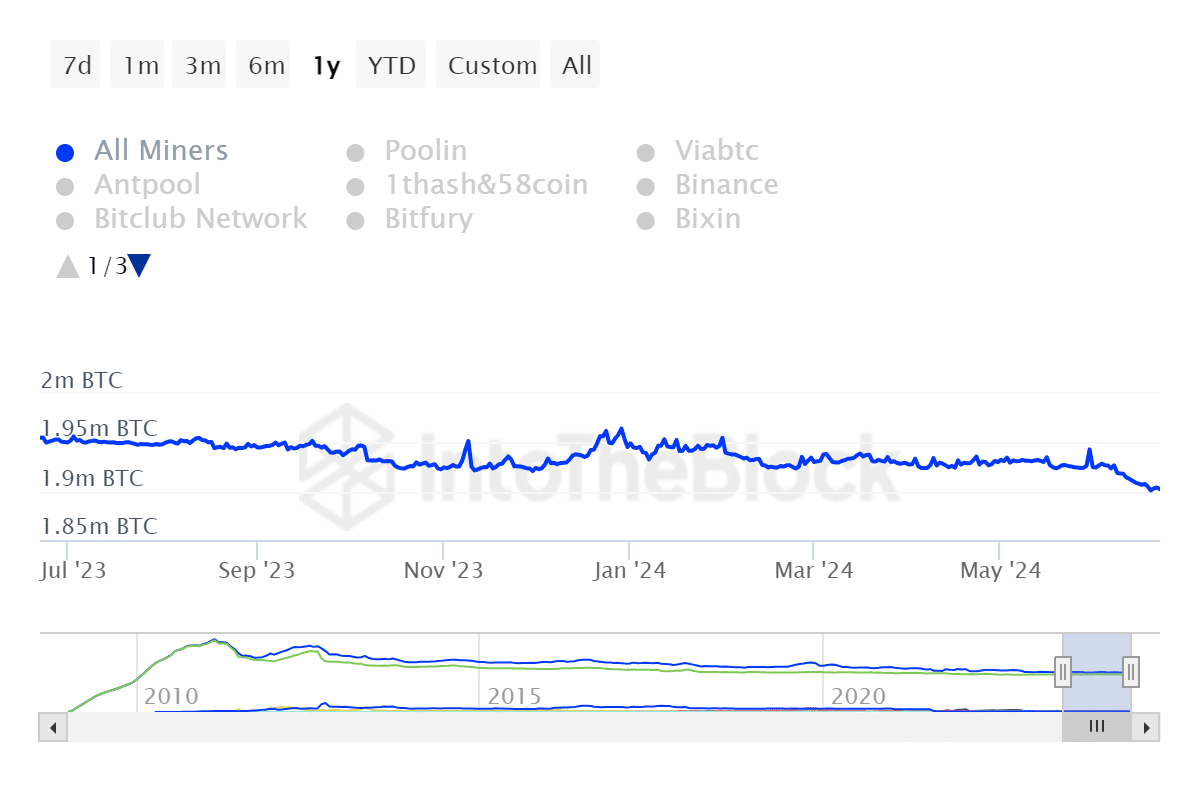

Significant Number of Addresses Invested in Bitcoin at Current Price Range

Data from IntoTheBlock reveals that the current price range for Bitcoin, between $63,493 and $64,931, has attracted nearly 1.9 million addresses. These investments at key levels signify the dynamics of market support and resistance.

With a large number of investors around this price point, it poses a strong resistance level for Bitcoin’s upward movement.

Conversely, it can also serve as a support level when the price retreats, as investors look to average their costs and avoid losses by holding onto their investments.

Miners Adjusting to Market Conditions

Miner activity has surged this year, with approximately 30,000 BTC worth $2 billion sold since June. This rise in selling pressure could be attributed to market volatility or operational expenses.

Source: IntoTheBlock

These miner transactions play a crucial role in shaping Bitcoin’s supply and demand dynamics, influencing the overall price structure.

Explore Bitcoin’s [BTC] Price Prediction 2024-25

Considering the large number of BTC held within this price range and the miners’ selling activity, the market remains on edge about potential price movements and support and resistance levels.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!