Analysts forecast Bitcoin rate maximize following halving, with conditions.

- New developments in the Bitcoin industry may well have triggered some uncertainty.

- Conversations bordering the selection to keep or provide Bitcoin have surfaced because of to marketplace shifts.

Just a several times back again, Bitcoin [BTC] went by way of its extremely-predicted halving event, and its rate conduct article-halving has been a topic of discussion owing to its unpredictability.

As for every CoinMarketCap, the premier cryptocurrency confirmed constructive benefits on its weekly chart at the moment, indicating a sizeable bullish craze in the marketplace.

Effect of Bitcoin halving

Anthony Pompliano shed light on the 30 days just before and following the Bitcoin halving occasion, mentioning in a modern discussion with Bloomberg that,

“Historically, we’ve observed that the halving will take some time to have an impression.”

Citing insights from a Bitwise report, he further more mentioned,

“In the thirty day period major up to the halving, the common return throughout former bull markets was 19%, whereas in the thirty day period pursuing the halving, it was 1.7%.”

This implies that though brief-phrase fluctuations may occur before and right after the halving party, the in general craze tends to show an upward motion.

When looked at carefully, this sample aligns with primary economic rules: when the demand from customers for Bitcoin continues to be frequent but the provide is minimized by half, the selling price is probable to adjust to maintain market equilibrium.

Pompliano predicted that this time, the end result could possibly observe the proven pattern.

He predicted a potential upward climb in Bitcoin’s selling price in the future months, in line with historical trends.

“I feel this time will not be any diverse.”

Expressing a identical viewpoint, Vijay Boyapati, author of “The Bullish Circumstance for Bitcoin,” remarked,

“All other variables remaining continual, if demand from customers for bitcoins stays the exact same, the halving could direct to surplus need above offer, creating the price to go up.”

What do the figures expose?

Even so, in contrast to the aforementioned viewpoints, Layah Heilpern, Host of The Layah Heilpern Exhibit, added,

“If you do not capitalize on profits throughout this crypto bull run, you are missing out massive time…”

This illustrates Heilpern’s shifting viewpoint. When she previously supported holding on to cryptocurrencies indefinitely, she now indicates providing on reaching considerable profits throughout this cycle.

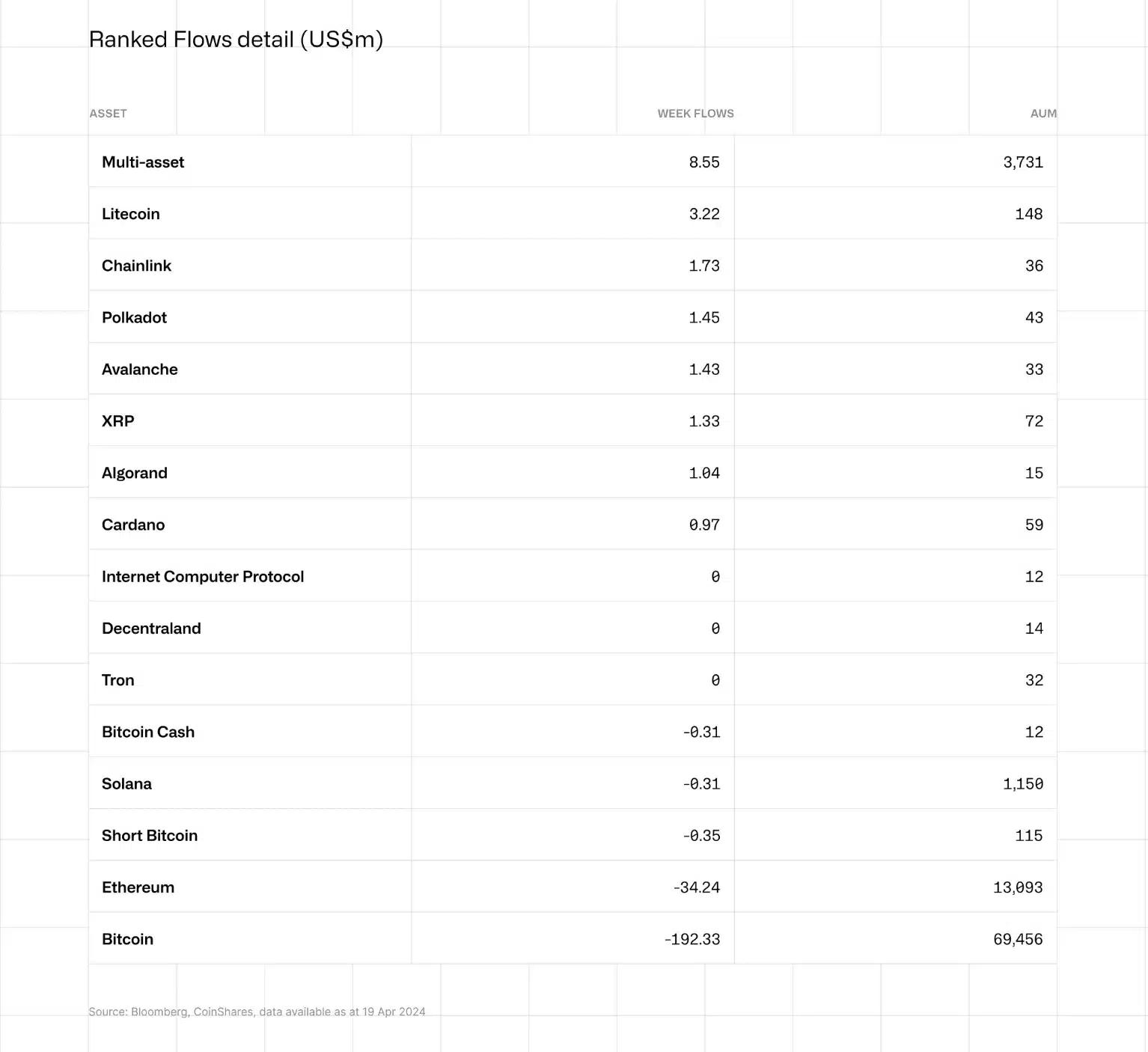

Looking at the data from CoinShares, cryptocurrency outflows totaled a significant $206 million, with Bitcoin top at $192 million, closely followed by Ethereum [ETH] with $34 million.

Resource: CoinShares

Hence, while brief-time period fluctuations may trigger preliminary worry, the long-time period prospects of Bitcoin supply important advantages.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!