Australia Joins Bitcoin ETF Development: Will BTC Continue on to Increase?

- Exciting news inform: Hong Kong is about to kick off buying and selling for Bitcoin ETFs this week!

- Australia is hopping on the BTC ETF bandwagon also could this enhance BTC costs in the APAC area?

Get all set for the groundbreaking start of the “in-kind” Hong Kong Bitcoin [BTC] ETFs! They’re all set to hit the industry on Tuesday, April 30th, and experts are contacting it a sport-changer for Asia.

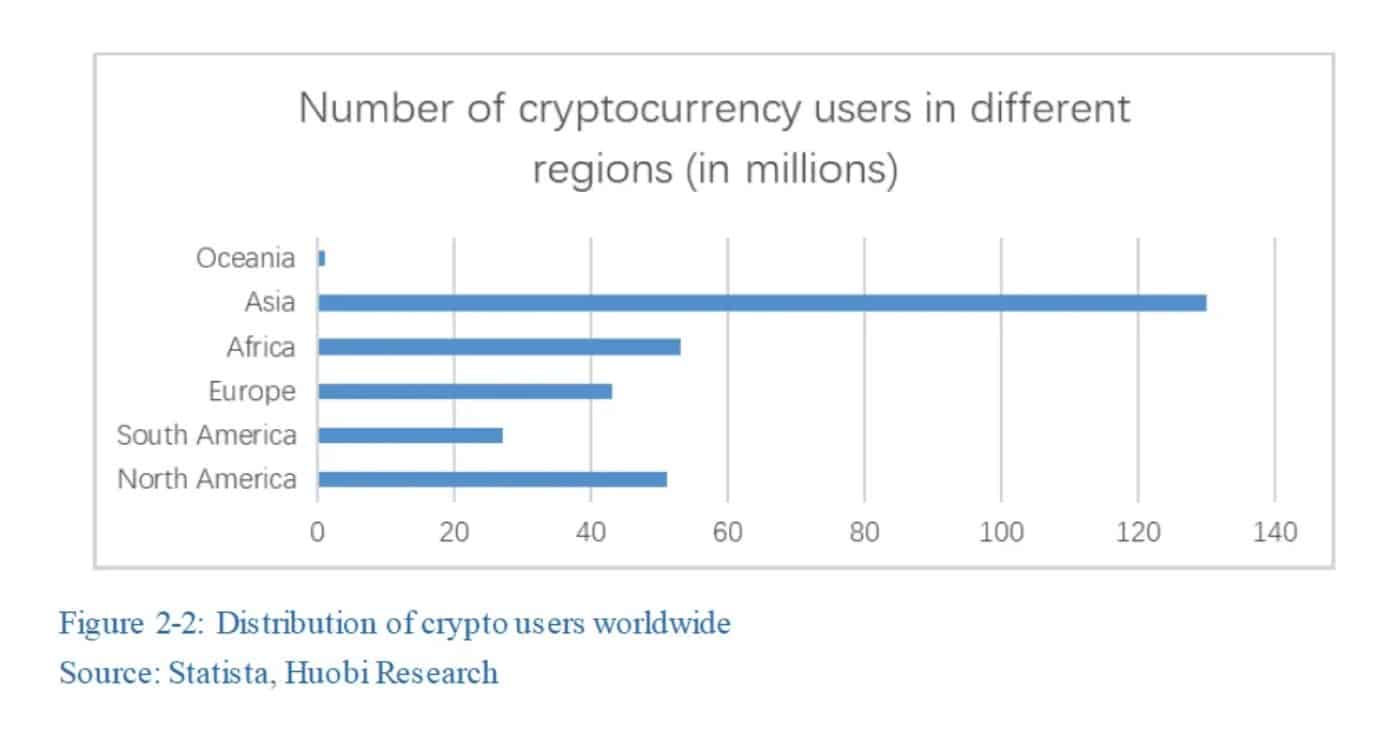

Renowned sector analyst, Willy Woo, highlighted the significance of the Hong Kong ETF by pointing out Asia’s massive crypto user foundation.

The Asian sector in consumer rely is More substantial than the US and European marketplaces mixed.

Supply: X/Willy Woo

It really is Time for Fee Wars and Sector Advancement with Hong Kong Bitcoin ETFs

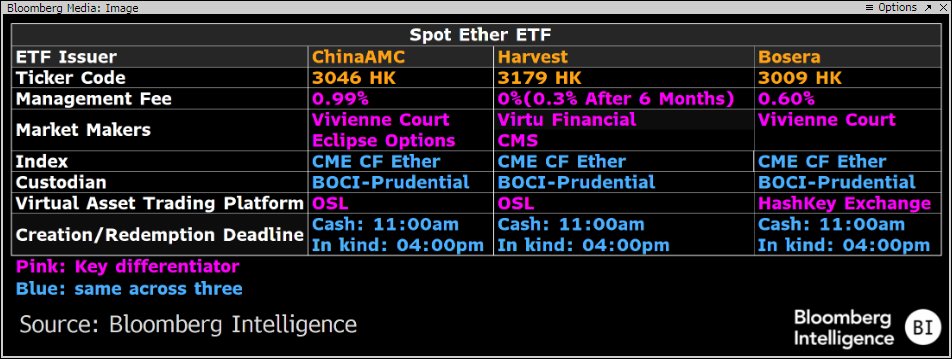

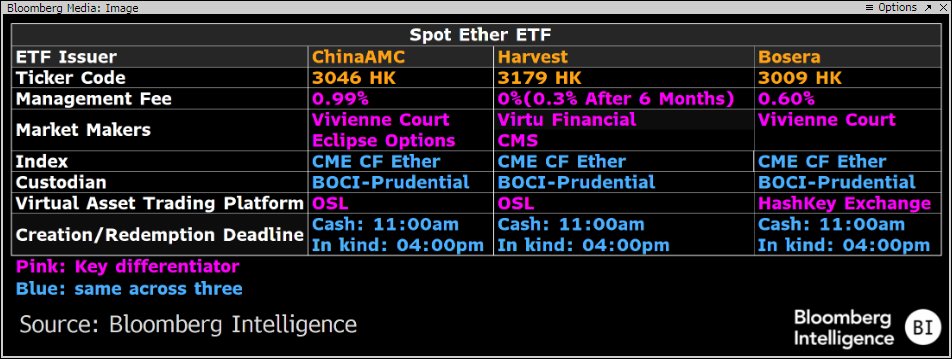

The very first wave of permitted goods from Bosera, ChinaAMC (Hong Kong), and Harvest Fund is hitting the Hong Kong inventory trade on April 30th.

Noted Bloomberg analyst James Seyffart observed that Hong Kong issuers are featuring incredibly low costs, sparking potential cost wars.

“A possible cost war could break out in Hong Kong in excess of these #Bitcoin & #Ethereum ETFs. Harvest coming in warm with a whole charge waiver and the most affordable cost at .3% right after waiver.”

Source: X/James Seyffart

The anticipation was higher about the possible impression of Hong Kong place BTC ETFs on BTC prices as soon as they kick off investing.

A forecast by Singapore-dependent crypto analysis business, Matrixport, predicted that Hong Kong’s place BTC ETFs could catch the attention of $25 billion in investments.

However, Bloomberg analyst Eric Balchunas revised the estimates downward as limits loomed for Mainland China.

He up to date his preliminary estimate to $1 billion in AUM (property beneath administration), mentioning that,

“Our asset estimate is now $1b in the initial two yrs (which is nutritious IMO but nonetheless nowhere close to the $25b that some have stated), but a great deal depends on infrastructure improvement.”

Additionally, the report highlighted that the APAC location at present retains about $250M in BTC ETFs break up between cash in Hong Kong and Australia.

“The Asia-Pacific region’s BTC ETFs at the moment handle $251 million in assets, break up involving a few funds in Kong Kong and two in Australia.”

Australia Can take a Cue from the U.S. and Hong Kong Bitcoin ETF Pattern

Australia, way too, is gearing up to introduce extra place BTC ETFs on the Australian Stock Trade (ASX).

A current Bloomberg report from April 29th highlighted that potential issuers like Van Eck, BetaShares, and DigitalX have used for place Bitcoin ETFs in Australia.

When ASX has not delivered a timeline but, a favorable approval could generate institutional adoption and reinforce the Hong Kong Bitcoin ETFs and the broader APAC region.

As of now, BTC’s cost is just over its most affordable stage of $60.8K variety.

With the US Fed fee choice on Wednesday and major liquidity indicating an upward trend, brace by yourself for some wild market swings this 7 days!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!