92% of MATIC addresses are ‘unprofitable’ and what does this necessarily mean…

- Quite a few MATIC addresses are at present in an “out of the cash” predicament

- Reducing whale transactions could direct to a lot less volatility and help a favourable uptrend

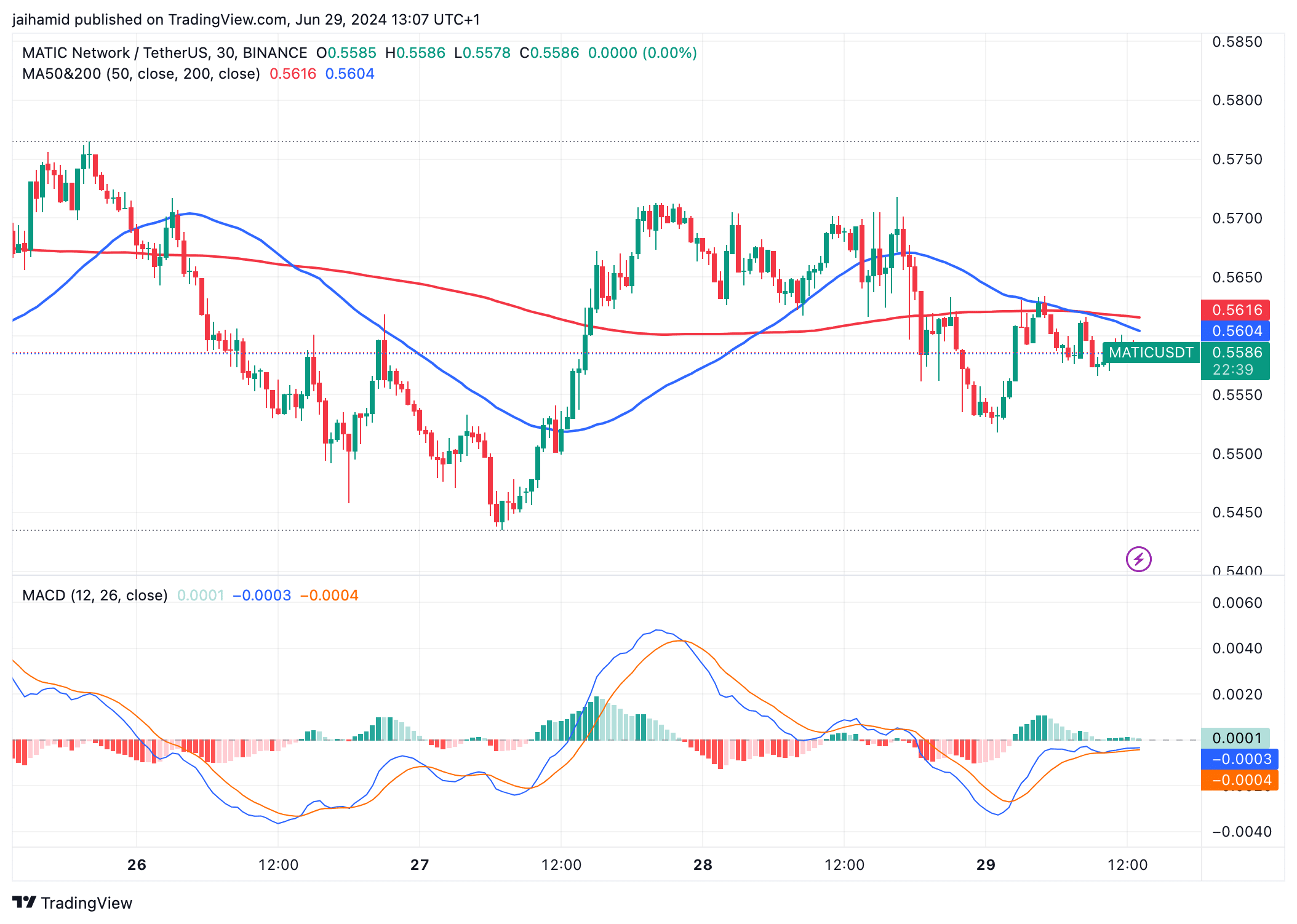

Exciting developments are going on with Polygon’s native token, MATIC, as it not long ago arrived at a 9-month low on the price charts. This information has caught the consideration of equally traders and traders. Irrespective of the bearish outlook, the Relocating Typical Convergence Divergence (MACD) indicator is hinting at a potential bullish turnaround in the in close proximity to foreseeable future.

Now, the MACD line is slightly under the Signal line, suggesting a bearish trend. Nonetheless, the close proximity of the two strains suggests a feasible bullish crossover before long.

Resource: TradingView

At this time, MATIC’s value is beneath equally the 50 and 200-period of time Moving Averages, indicating a limited-time period bearish development.

These aspects, combined with the likely MACD bullish crossover, suggest that potential buyers are gaining momentum. This could be a essential step in reviving bullish sentiments in the altcoin marketplace.

Bears Nonetheless Lurking

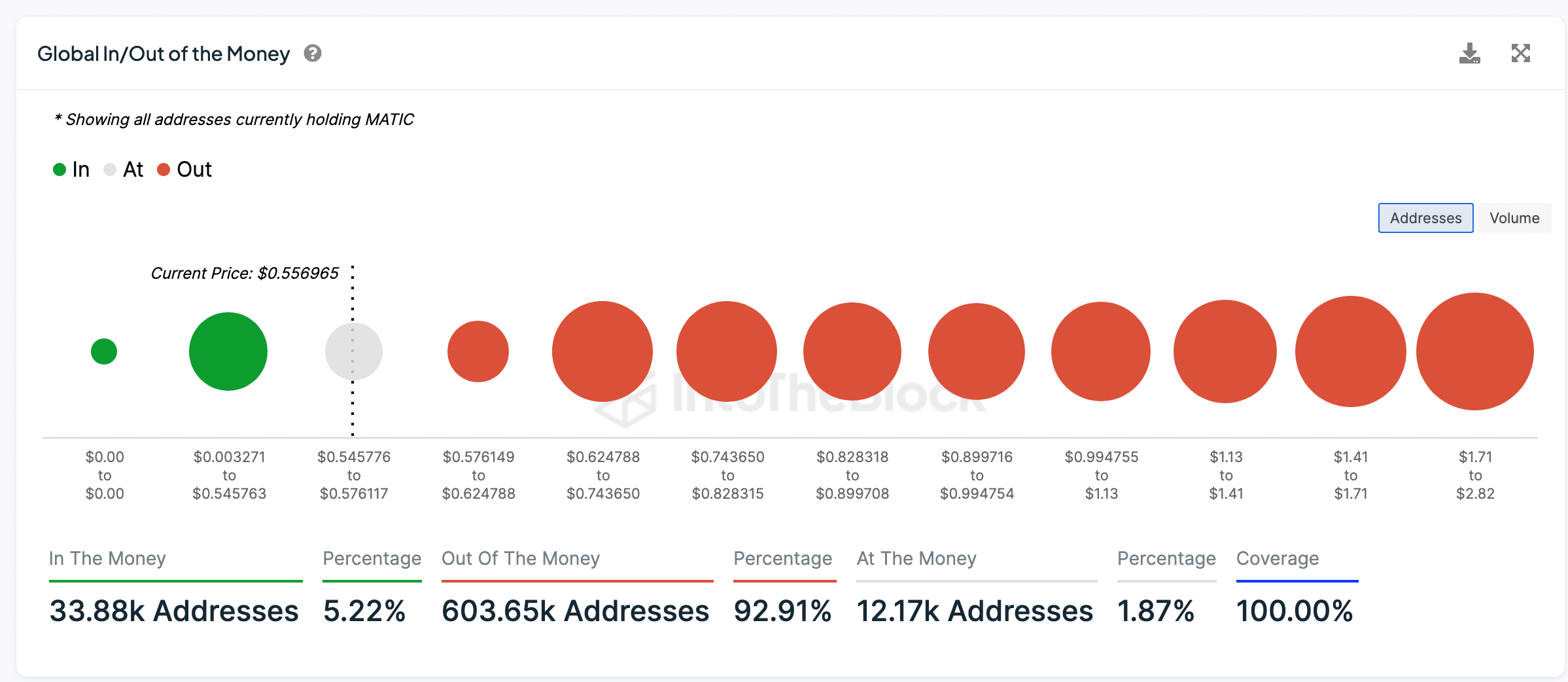

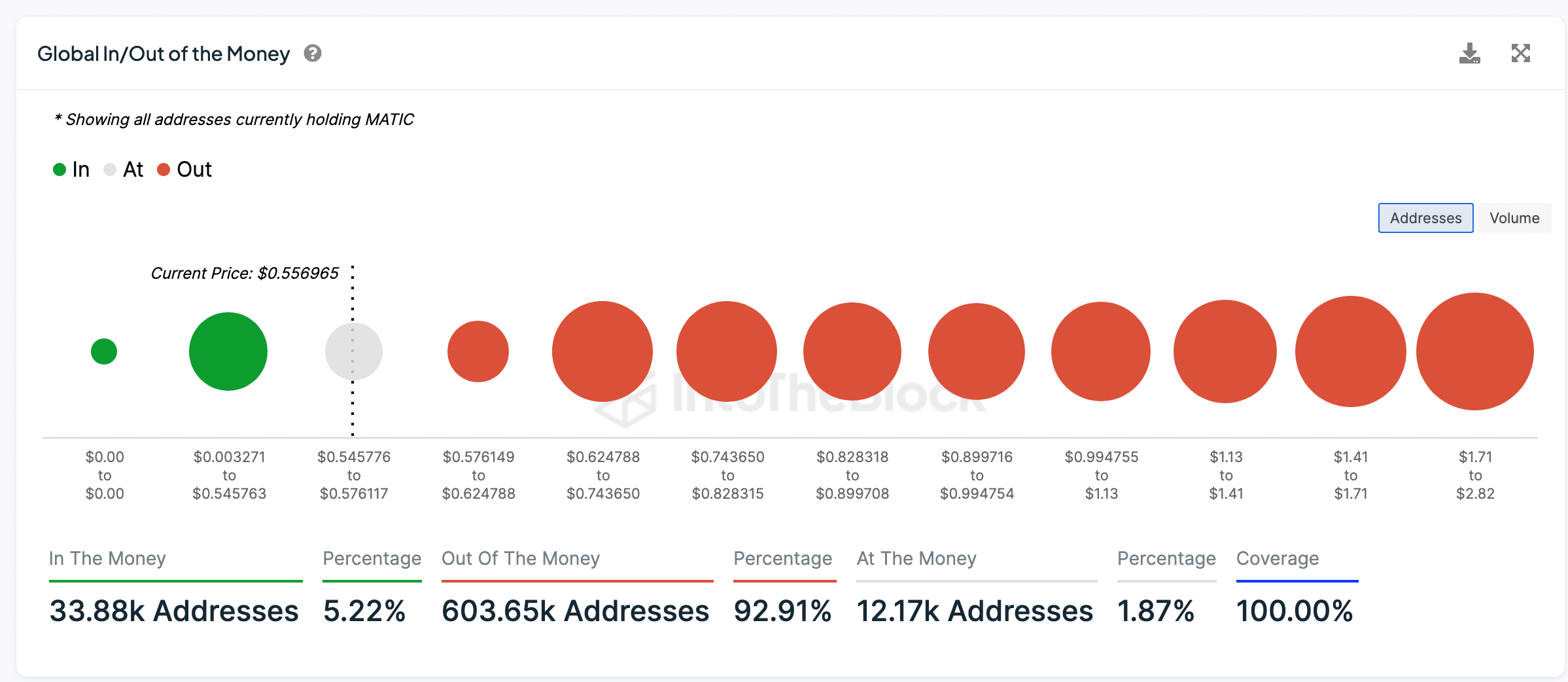

The the vast majority (92.91%) of MATIC addresses are at the moment in an “out of the revenue” predicament, the place their holdings are valued less than their buy value. In contrast, only a little percentage (5.22%) are “in the dollars.”

Supply: IntoTheBlock

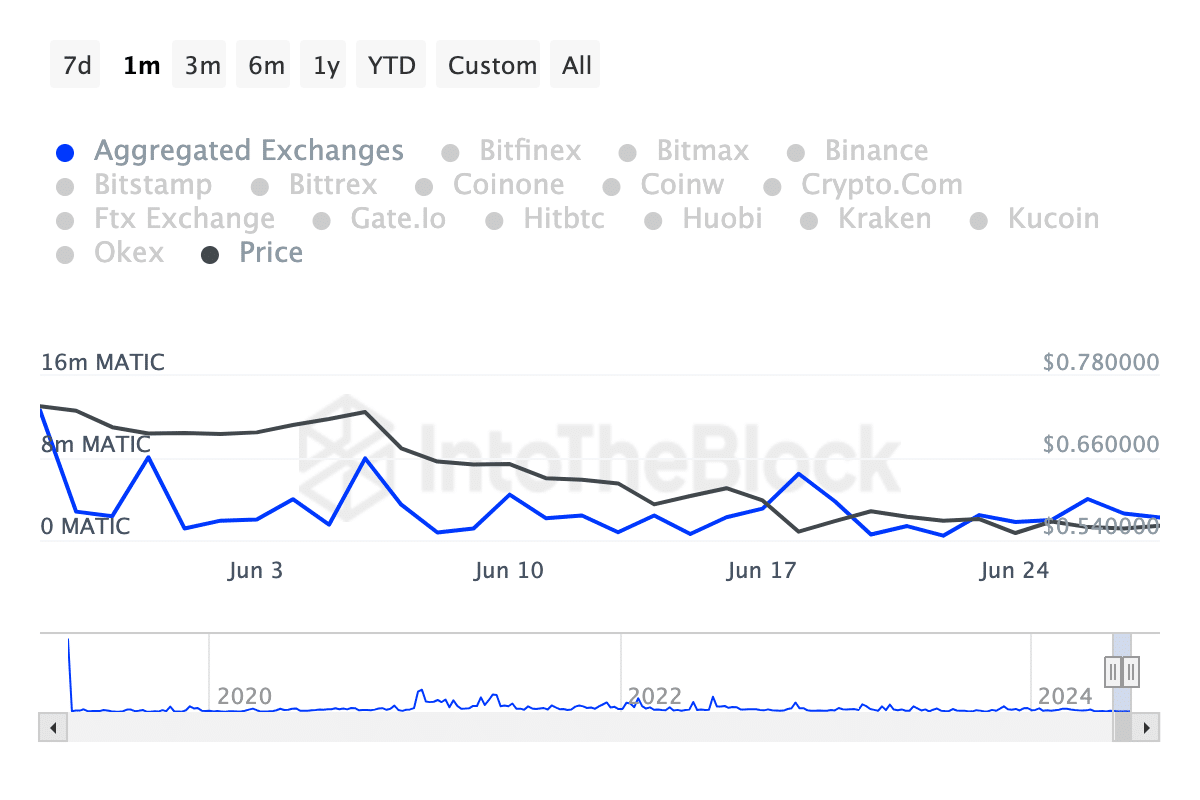

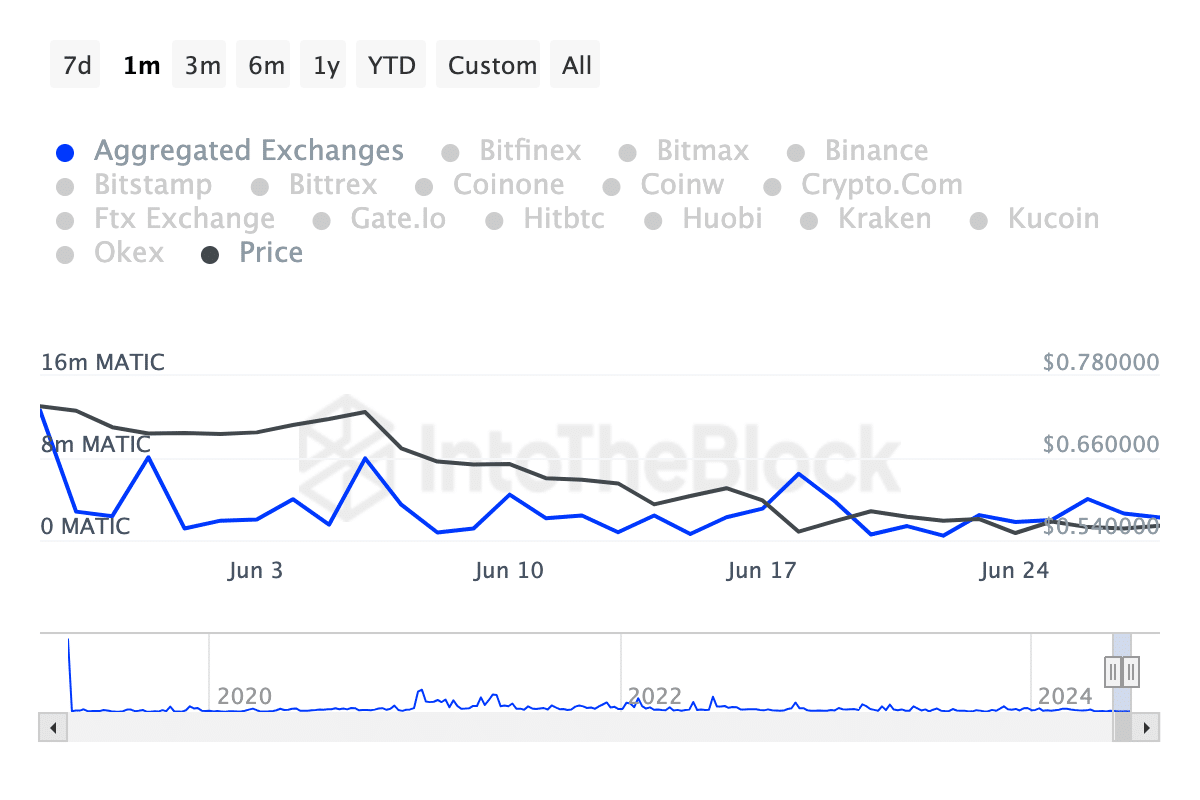

Important spikes in inflow volumes on exchanges generally point out amplified providing tension as traders transfer their tokens to exchanges for opportunity gross sales.

However, latest tendencies in MATIC exhibit a stabilizing or reducing pattern in inflows, suggesting a reduction in quick promoting tension.

Resource: IntoTheBlock

When outflows have remained regular, indicating no sizeable rise in offering force lately.

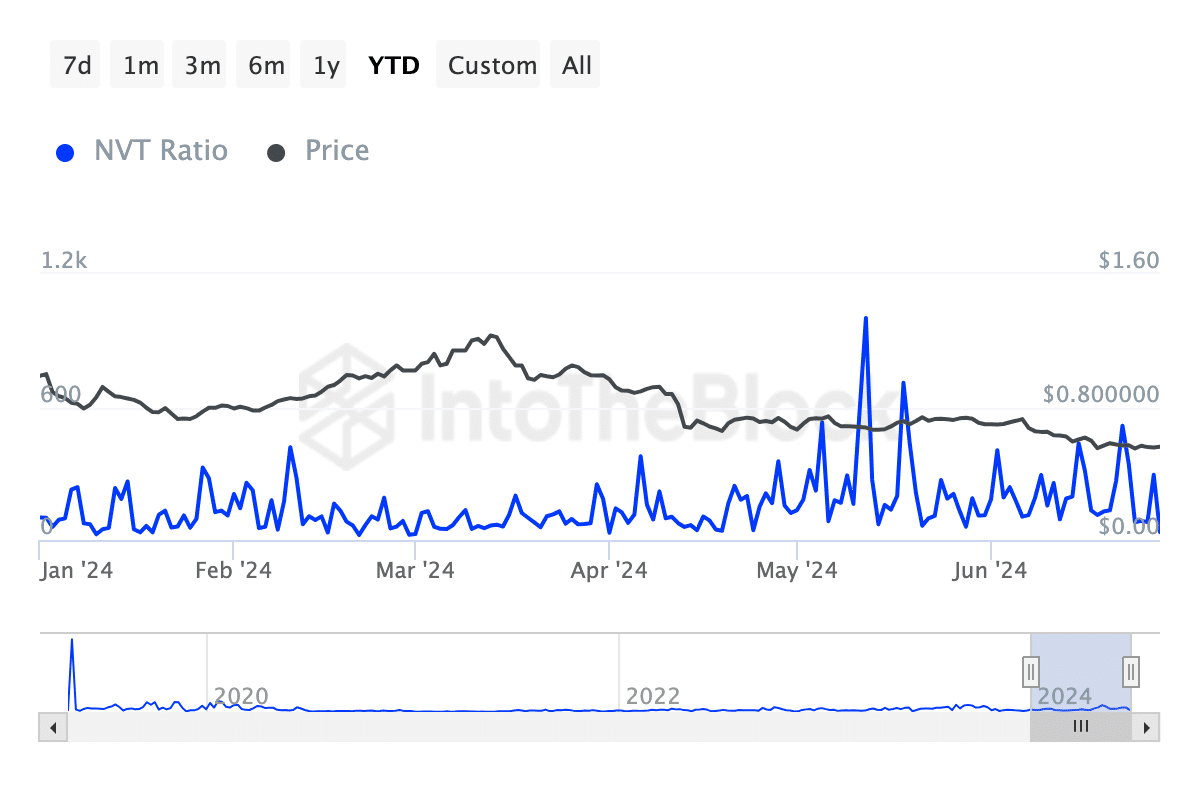

The NVT ratio has displayed some fluctuations but is frequently trending downwards, suggesting both an maximize in transaction volume or reduce in network value. This could be observed as a beneficial signal if the increase in transaction volume is sustainable.

Supply: IntoTheBlock

Furthermore, whale transactions are exhibiting a reduce, indicating significantly less activity from big investors and reduced speculative investing at high volumes. This downward pattern could lead to decreased volatility in the quick time period.

To fuel a bullish reversal, current market sentiment requires a sturdy bullish bring about connected to community developments or broader economic trends.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!