Why 2024 is a blended bag for Arbitrum and Optimism

- Enjoyable News: Arbitrum and Optimism are buzzing with extra transactions this year!

- Catch the updates on ARB and OP in the present sector circumstance!

Arbitrum [ARB] and Optimism [OP], the dynamic Layer 2 scaling methods for Ethereum [ETH], have been witnessing a surge in transaction action, as for each modern info analysis.

While the transaction volume is on the increase, the Full Price Locked (TVL) for equally networks has taken a hit lately. Furthermore, the native tokens’ benefit has also gone down.

Breaking: Far more Transactions on Arbitrum and Optimism

The latest results by IntoTheBlock spotlight a quadruple increase in transaction quantity for foremost Ethereum Layer 2 solutions like Arbitrum and Optimism in the previous yr.

The surge, notably in the next quarter, can be attributed to the integration of Ethereum Enhancement Proposal (EIP) 4844.

EIP-4844 aims to improve Ethereum scalability by introducing a additional successful transaction type, ensuing in lower charges and increased throughput.

Even more data from Growthepie suggests that Arbitrum has observed substantial growth this 12 months when compared to Optimism.

Prior to the surge in activity, ARB transactions were below 1 million. Nevertheless, write-up-March, there was a considerable spike, crossing above 1 million and reaching a peak of close to 2.6 million transactions on June 26th.

In contrast, OP expert a peak in early April with over 800,000 transactions, but has viewed a drop considering that then.

Presently, ARB maintains substantial action with more than 1.5 million transactions, when Optimism has dipped to more than 409,000 transactions.

Drop in TVL for Arbitrum and Optimism

The Complete Value Locked (TVL) on Layer 2 options like Arbitrum and Optimism, as per DeFiLlama, at first rose but has been on a downward craze lately.

Arbitrum saw its TVL peak in March at about $3.1 billion, reflecting a period of major adoption and financial investment. The most up-to-date details demonstrates a decrease to about $2.7 billion.

Likewise, Optimism hit the $1 billion mark in TVL in March but has now dropped to close to $665 million, mirroring ARB’s pattern.

Decreases in TVL for each networks could be because of to modifications in trader sentiment, broader market place circumstances, or particular occasions inside of the Layer 2 ecosystem.

Robust Resistance Facing ARB and OP

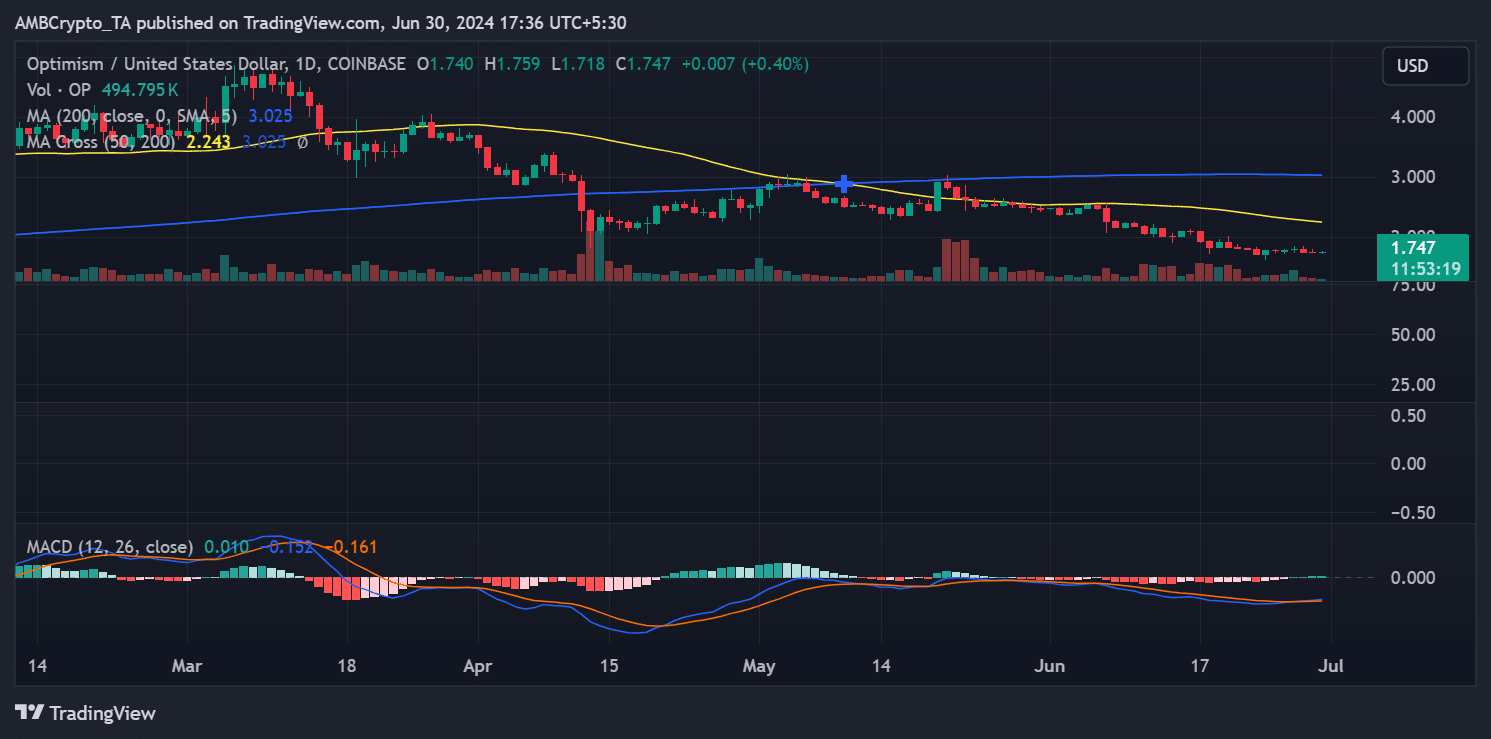

The price examination for ARB and OP indicates a downward craze, as comprehensive in AMBCrypto’s report.

OP is presently experiencing a rough resistance at all around $2.2, with a slight increase to $1.7 at present.

On the other hand, ARB is hovering all-around $.7, with resistance established all-around $1. The two tokens demonstrate signals of bearish sentiment, suggesting a careful market outlook.

Resource: TradingView

Interested in your portfolio’s general performance? Attempt the ARB Earnings Calculator!

As the tokens experience resistance ranges, it is very important to monitor market motion for knowledgeable expenditure decisions.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!